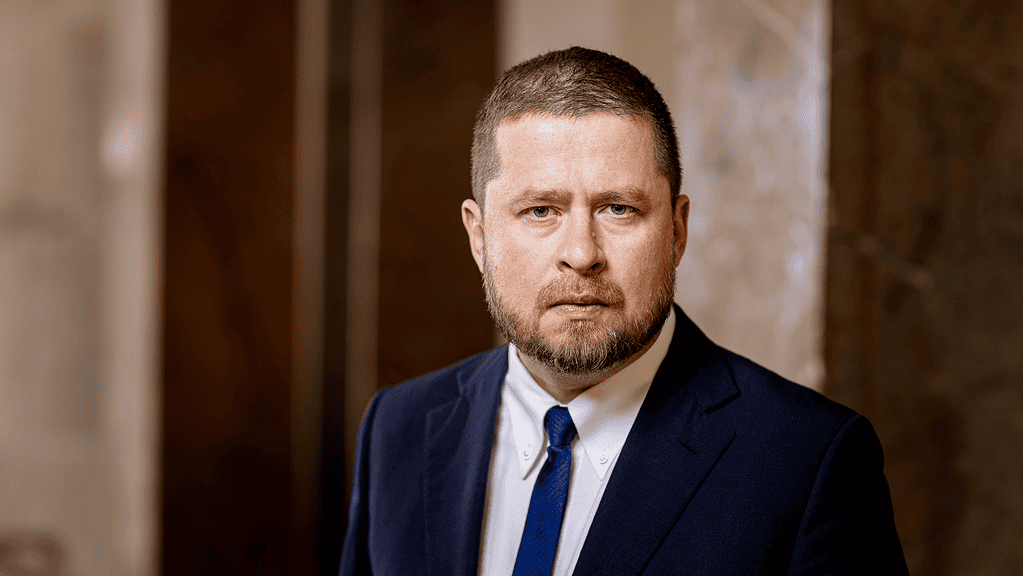

Aleš Michl approaches economic challenges very differently from his predecessors and his counterparts in other countries, with impressive results.

Global Finance: You are halfway through your six-year term as governor of the Czech National Bank (CNB), and inflation has fallen from 17.5% to around 2.5% today. How did you achieve this?

Aless Michl: We have changed not only the strategy, but also the philosophy. The previous board had kept rates at zero for too long, doubled the money supply by weakening the crown, and then suddenly raised rates when inflation was already there. Instead of sharp, volatile moves, we kept interest rates higher for longer. We added a strong crown policy, which made imports of energy and raw materials cheaper. This combination resulted in the tightest monetary conditions in 25 years. This reduced money creation and slowed demand, and eventually inflation fell. Sometimes less is more: stability, patience, credibility. The new philosophy is never again to create long-term inflation by setting zero rates or printing money – this has always backfired in history.

GF: Your strategy of not significantly raising interest rates to curb inflation differs from the way countries like Turkey have fought inflation. Is this because the Czech economy is different, or are there also underlying philosophical reasons?

Michl: Monetary policy must be coherent and credible, and not experimental. One experiment is to have zero rates for more than 10 years – rates that are even negative in real terms – to create inflation, and then, when inflation comes, thinking that it can be quickly defeated by sudden increases. This is a mistake from the past and we must admit it. I prefer to keep prices high for longer and communicate clearly. The goal is low inflation.

GF: The global economy has changed dramatically in recent years. What changes have affected the Czech Republic the most?

Michl: The world continues to change, but humanity continues to repeat the same mistakes. We must remember that too much debt and too much cheap money leads to higher inflation. We can never predict exactly what will change the world. But it is easier to understand that nations, households, entrepreneurs and businesses that hold on to savings, wealth and reserves in good times, not piles of debt, are better able to absorb shocks when disaster strikes.

GF: The CNB’s foreign exchange reserves currently stand at around 135 billion euros. During your tenure, its gold reserves increased from around eight tonnes to 65 tonnes, with plans to increase them to 100 by 2028. You doubled your stock holdings to around 25%. What is the reason for this diversification?

Michl: In the past, we have suffered significant cumulative losses caused by poor asset-liability management. Our assets – our foreign exchange reserves – had low expected returns compared to the cost of our liabilities. We have changed this significantly. We have increased the long-term expected return on our assets, particularly reserves. We hold more stocks and gold. At the same time, we reduced our liability costs: we increased the minimum reserves that banks are required to hold and we stopped paying interest on them. We have removed the cause. The last two years have been profitable. But we cannot expect profits every year. There will be years when CNB will be in a loss – perhaps in 2025 or another year. The bottom line is that our assets are now structured to provide an expected long-term return in excess of the expected cost of our liabilities.

GF: Are you considering joining the Eurozone at some point?

Michl: Not in the near future. The crown is our anchor. This helped us fight inflation by keeping imports cheaper. There are much more important issues than the euro. The Czech National Bank will soon be an institution that uses artificial intelligence to better supervise the financial market. We are also studying blockchain technologies, as they are becoming an important part of modern financial and payment systems. It will use real-time data and machine learning to predict seizures. In its supervisory process, the BNC will systematically use AI not only for analytical purposes, but also for automatic decision-making in selected areas.

The next generation of bankers will think in a completely different way: with real-time data and algorithms and systems that will be better partners in decision-making than our previous models. The vision is of a bank that helps people dream of a future without fear of inflation. A bank that ensures financial stability by working with data and technology. And it will also be an institution where employee ethics will prevail. The culture within the institution is crucial to me. All this is more important than the adoption of the euro.